Key takeaways The NCUA (National Credit Union Administration) insures credit union deposits up to $250,000 per depositor, per institution, per ownership category. NCUA insurance provides the same protection as FDIC insurance at banks. Both are backed by the full faith and credit of the U.S. government. Joint accounts receive $250,000…

Key takeaways Your credit card APR can go up if the prime rate changes, you paid your credit card bill late, your intro APR offer ended or your credit score dropped. If your APR increases, you can work on paying down your balance or transfer your balance to a card…

Image by PM Images/Getty Images; Illustration by Hunter Newton/Bankrate Mortgage rates fell this week, with the 30-year fixed rate averaging 6.18%, down from 6.25% last week, according to Bankrate’s latest lender survey. Current mortgage rates Loan type Current 4 weeks ago One year ago 52-week average 52-week low 30-year 6.18%…

Images by Getty Images; Illustration by Hunter Newton/Bankrate A construction loan is a short-term, high-interest loan used to finance building a home. Funds are paid out in phases over the course of construction and typically cover land, materials, contractor labor and permits. They tend to have stricter qualification requirements than…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

DenisTangneyJr/Getty Images Key takeaways Bridge loans are short-term loans that help cover costs during transitional periods, most often if you must buy a new home before selling your old one. Like a mortgage, your home may serve as collateral for a bridge loan. Some bridge…

Dept Managmnt

2. Coaching and Tutoring Take stock of your areas of expertise – maybe you speak a second language or solving math equations comes…

Banking

These entrepreneurs, traders and investors are making an outsized impact in fintech, crypto and traditional financial services.By Jeff Kauflin, Hank Tucker and Nina…

Credit Cards

All News

Westend61/GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways FHA 203(k) loans provide funding to finance both a home’s purchase and the cost of repairing it. This type of loan, which you can obtain from an FHA-approved lender, is reserved for borrowers who intend to live in the home, not house-flippers or…

Key takeaways If your annual income is less than the standard deduction, you likely aren’t required to file a tax return. But exceptions apply to self-employed people, taxpayers who file as married filing separately and others. The standard deduction for the 2025 tax year, for tax returns filed in 2026,…

Tax credits are a powerful way to save money on taxes. Each dollar of a tax credit is subtracted directly from the amount of tax you owe the IRS. And some tax credits are refundable, meaning even if you don’t owe any tax, the credit is paid out to you…

Key takeaways Your homeowners insurance premium may increase after a successful claim. The severity of the claim can impact the amount of the increase. Looking for discounts and shopping around are two ways to keep your rate reasonable. You’ve probably heard that your insurance can go up if you file…

Key takeaways Investing in an S&P 500 index fund is an easy way to get instant exposure to hundreds of the largest companies in the U.S. in one investment vehicle. All S&P 500 funds are fundamentally invested in the same stocks, so choosing the “cheapest” one (the one with the…

Whether you can claim an adult child as a dependent on your taxes depends on their age, income and living situation, as well as the level of financial support you provide to them. The IRS allows parents to claim certain adult children if they meet the criteria for either a…

With interest rates somewhat in flux, savers and investors might have to search a little bit harder to find the best returns from relatively safe investments such as money market funds. Money market funds invest in short-term securities issued by governments and corporations and are available from several different brokers…

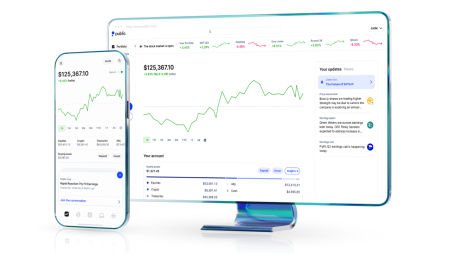

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program. Other key features include: Fractional shares, so you can trade with as little…

A nursing home cannot directly seize funds held in an individual retirement account (IRA). However, retirement accounts in many states are generally treated as countable assets for Medicaid eligibility, which means their value can affect whether you qualify for Medicaid coverage of long-term care. In many cases, this requires a…

Capital gains are the profit you earn when you sell an asset like a home, business or stocks. Those gains are subject to capital-gains taxes, but capital gains are taxed differently depending on the type of asset — and how long you owned the asset. That’s because, while the federal…